Real-World Assets Inheritance: Beyond Simple Tokenization

We talk a lot about tokenization but often forget that ownership isn’t just about returns.

It’s about responsibility.

Real estate, company shares, collectibles, vehicles: these assets belong to people, families, generations. And while Web3 is redefining ownership, one crucial question remains unanswered:

What happens when something happens?

This is where Awareo comes in with a platform that not only digitizes Real-World Assets (RWAs), but also protects, manages, and securely transfers them.

Real-World Assets: Ownership That Matters

RWAs aren’t just investment classes. They are part of real life.

A house meant to be inherited. A company stake that needs protection.

A car jointly owned by multiple people.

Yet many Web3 projects focus solely on trading these assets.

Tokenization as a financial product without solving access, management, or succession.

Awareo flips the perspective: it’s not about the market, it’s about the people.

What do you own? What happens if you can’t manage it anymore? And how can you ensure nothing gets lost?

What Awareo Does Differently – Visibility is Step One

Most assets today may be digital but they’re scattered and invisible:

buried in folders, emails, contracts, or worse stored only in someone’s memory.

Awareo starts by bringing clarity.

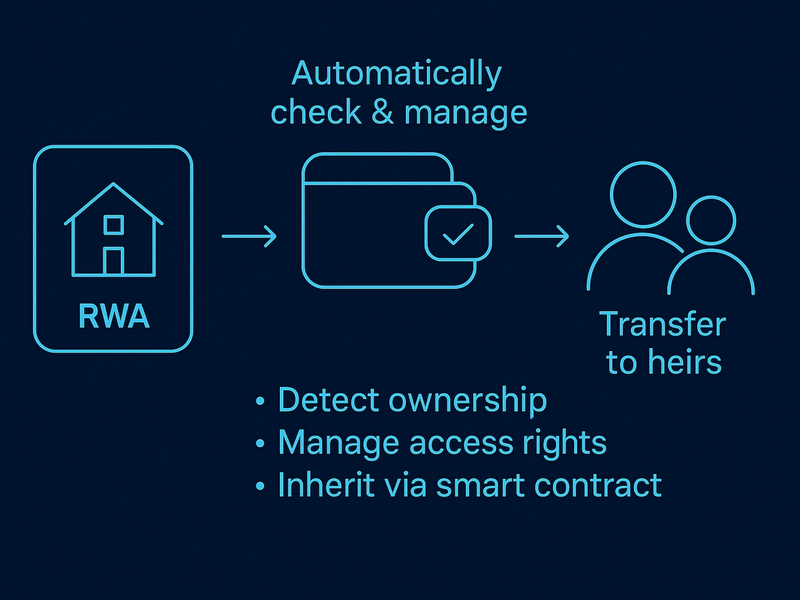

- Asset detection via AI: Our assistant analyzes documents, contracts, and wallets, identifies relevant assets, and organizes them.

- Real-world access control: Who currently has access? What deadlines apply? What’s missing?

- Smart contract–based handover: In case of death, illness, or voluntary transfer, automated, privacy-compliant rules are triggered.

What platforms like Centrifuge or Brickblock tokenize, Awareo completes with the real-world logic to manage it.

Tokenization Needs More Than Tech-It Needs Foresight

If you tokenize a property into 1,000 tokens, one day you’ll have to ask:

What happens to these tokens when something goes wrong?

- A co-owner passes away.

- A court order reshuffles ownership during a divorce.

- A business founder wants to clearly assign digital assets after their passing.

Awareo fills that gap. We complement tokenization platforms with what they often lack:

Access control. Succession planning. Compliance.

Whether it’s a fund, a trustee, or a DAO wherever RWAs are held or managed, Awareo provides the structure for clarity, fairness, and security.

For Families. For Businesses. For Real Life.

It’s not just individuals who benefit. Companies also manage real-world assets and need rules about who has access.

- Who gets access to the corporate wallet if the CEO is gone?

- How are shares managed when a co-founder leaves or dies?

- Which contracts should auto-cancel in case of exit or death?

Awareo anticipates these questions and gives companies the tools to act responsibly, securely, and without needing technical expertise.

Conclusion: RWAs Deserve More Than a Token, They Deserve a System

Real-World Assets are more than just value they are responsibility.

Awareo makes them visible, manageable, and fairly transferable.

Not just on paper, but in real life.

If you tokenize, you need more than a smart contract.

You need a digital operating system for ownership and that’s what Awareo delivers.